While reconciling your bank statement would be considered a financial reconciliation since you’re dealing with bank balances. And generating financial reports in Clio Accounting is a breeze, making your life, and your accountant’s life that much easier. The goal of bank reconciliation is to check that ending balances match on both your bank statement and your records. Should there be any discrepancies that come up through the reconciliation process, you can then take action to resolve them.

Another factor that seems to be unavoidable, no matter how diligent your accounting team is, is the total boycott of a transaction. Comparing accounts helps you spot transactions you have missed and keeps all your records as consistent with each other and accurate as possible. The accountant of company ABC reviews the balance sheet and finds that the bookkeeper entered an extra zero at the end of its accounts payable by accident. The accountant adjusts the accounts payable to $4.8 million, which is the approximate amount of the estimated accounts payable. I was excited until I realized my primary job was to reconcile five bank accounts, none of which had been reconciled for over a year.

This is particularly helpful to organizations where a large number of transactions take place every day. Its powerful matching algorithms quickly identify and resolve variances, increasing speed and accuracy. This blog delves into the essentials of account reconciliation, outlining the step-by-step process, and exploring the various types of reconciliation. Understanding this fundamental practice is vital for businesses aiming to achieve accurate financial reporting and make informed decisions. Tick all transactions recorded in the cash book against similar transactions appearing in the bank statement. Make a list of all transactions in the bank statement that are not supported, i.e., are not supported by any evidence, such as a payment receipt.

Consequences of Not Reconciling Your Bank Statement

A three-way reconciliation is a specific accounting process used by law firms to check that the firm’s internal trust ledgers line up with individual client trust ledgers and trust bank statements. For lawyers, this process helps to ensure accuracy, consistency, transparency, and compliance. The reconciliation process involves comparing internal financial records with external documents to identify and correct discrepancies. This includes investigating any differences, making necessary adjustments, rules and recommendations of working with retained ratio and documenting the process for accuracy. Finally, the reconciliation is reviewed and approved to ensure the financial records are accurate and complete.

Step 2: Reconcile internal trust accounts and client ledgers

Interest is automatically deposited into a bank account after a certain period of time.All trust transactions in the internal ledger should be accurately recorded and should align with transactions in the individual client ledgers.This includes investigating any differences, making necessary adjustments, and documenting the process for accuracy.Once the errors have been identified, the bank should be notified to correct the error on their end and generate an adjusted bank statement.For example, the internal record of cash receipts and disbursements can be compared to the bank statement to see if the records agree with each other.After careful investigation, ABC Holding found that a vendor’s check for $20,000 hadn't been presented to the bank.

As noted earlier, discrepancies are caused by various factors like timing differences, missing transactions, mistakes, or fraud, among others. Although not all discrepancies indicate an error in the general ledger account balance, it remains important to investigate each. Where the general ledger account balance is not consistent with or substantiated by information obtained from the supporting documents, the areas having these discrepancies expense ratio calculator the real cost of fees should be noted. Once the necessary details of the account have been collated, the next step is to compare or reconcile its balance to that of supporting or independent documents. Overall, account reconciliation plays an important role in a company’s risk management framework relating to accounting. One other use of account reconciliation is a company’s need to maintain an internal control environment that complies with Section 404 of the Sarbanes-Oxley Act.

Compares Different Account Balances

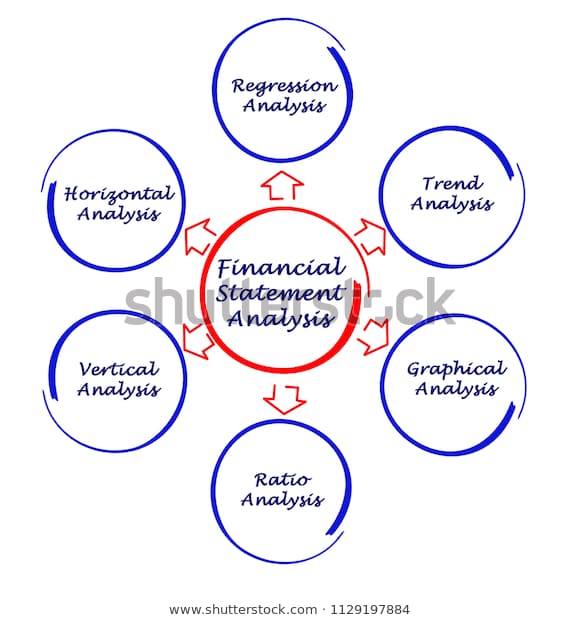

It's important to keep in mind that consumers have more protections under federal law in terms of their bank accounts than businesses. So it is especially important for businesses to detect any fraudulent or suspicious activity early on—they cannot always count on the bank to cover fraud or errors in their account. The reconciliation process includes reconciling your bank account statements, but it also includes a review of other accounts and transactions that need to be completed regularly. Account reconciliation comes in various forms, each tailored to address specific financial aspects and discrepancies within an organization.

Letting the bank reconciliation process slide can result in out-of-balance books, missing payments, unauthorized charges never being discovered, and missing deposits. A company may issue a check and record the transaction as a cash deduction in the cash register, but it may take some time before the check is cash and cash equivalents presented to the bank. In such an instance, the transaction does not appear in the bank statement until the check has been presented and accepted by the bank. It involves calling up the account detail in the statements and reviewing the appropriateness of each transaction. The documentation method determines if the amount captured in the account matches the actual amount spent by the company. In single-entry bookkeeping, every transaction is recorded just once rather than twice, as in double-entry bookkeeping, as either income or an expense.

Example of a Bank Reconciliation Statement

Whether you’re a small business owner working with multiple sub-ledgers or a multi-million dollar business using an ERP system, reconciling your accounts will always be necessary. Larger businesses with several branches may also need to complete intercompany reconciliations. While very small businesses can use cash basis accounting, if you have employees or have depreciable assets, you’ll need to use accrual basis accounting.